How to Get the Most of Your Social Security Benefits

Oct 14, 2024 By Kelly Walker

Navigating the complexities of Social Security can be challenging, but maximizing your benefits is crucial for financial stability in retirement. Understanding the ins and outs of Social Security can help you make informed decisions about when to start collecting, how much to expect, and strategies to boost your payout. This guide will provide you with essential tips and insights to ensure you get the most out of your Social Security benefits, setting the stage for a more secure and comfortable future.

What are Social Security Benefits?

Before diving into how to get the most out of your Social Security benefits, it's important to have a basic understanding of what these benefits are and how they work. Social Security is a federal program that provides retirement income, disability insurance, and survivorship benefits to eligible individuals and their families.

The program is financed by payroll taxes, with today's workers funding the benefits of current retirees. Essentially, if you have worked and contributed to Social Security taxes for at least 10 years, you qualify for retirement benefits upon reaching a certain age. The monthly amount you receive is determined by your earnings history and the age at which you begin collecting benefits.

Importance of Maximizing Your Benefits:

- Provides a stable source of income in retirement: Social Security benefits are a reliable source of income for retirees, with the potential to replace up to 40% of pre-retirement earnings. This can be especially beneficial for those who have not saved enough through other retirement accounts.

- Inflation protection: Social Security benefits are adjusted annually for inflation, helping to keep pace with rising costs of living.

- Protects against longevity risk: By providing a consistent stream of income for life, Social Security can protect you from the risk of outliving your savings.

- Increases lifetime retirement income: Maximizing your Social Security benefits can lead to higher monthly payments, which can add up to significant increases in lifetime retirement income. This is important when considering the potential length and cost of retirement.

Other factors that can affect your Social Security benefits:

- Work history: Your work history and earnings play a significant role in determining the amount of Social Security benefits you receive. It's important to review your earnings record periodically to ensure it is accurate and up-to-date.

- Age at which you start collecting: The earliest age to start receiving Social Security retirement benefits is 62, but doing so will reduce your monthly payments if you begin before reaching your Full Retirement Age (FRA). Conversely, delaying benefits beyond your FRA can lead to increased monthly payments.

- Other sources of income: If you have other sources of retirement income such as a pension or 401(k), this may impact the amount of Social Security benefits you receive. Additionally, if you continue working while receiving Social Security benefits before your FRA, there are limits on how much you can earn without reducing your monthly payment.

- Marital status: For married couples, there are different strategies for maximizing Social Security benefits. These may include "file and suspend" or claiming spousal benefits, which can increase overall household retirement income.-

How to Apply for Social Security Benefits?

Applying for Social Security benefits can be done online, in person at your local Social Security office or by phone. To apply, you will need to provide personal information such as your Social Security number, birth certificate, and proof of citizenship.

It's essential to understand that the amount of your benefit is calculated based on your 35 highest-earning years. Therefore, it can be beneficial to delay your application if your income has increased significantly in recent years. Furthermore, you need to determine whether to begin receiving benefits at 62, the earliest eligible age, or to wait until full retirement age (FRA), which ranges from 66 to 67 based on your birth year. Postponing benefits beyond FRA can boost your monthly payout by up to 8% for each year you delay until reaching age 70.

Strategies to Boost Your Social Security Benefits:

Delay Claiming Benefits:

One of the most effective strategies to boost your Social Security benefits is to delay claiming them. Although you are eligible to start receiving benefits at age 62, waiting until your Full Retirement Age (FRA), or even later, can significantly increase the monthly payout. For each year you delay past your FRA, up to age 70, your benefit amount will increase by approximately 8%. This strategy is particularly advantageous for those in good health and with longevity in their family history, as it can result in a substantially higher lifetime benefit.

Work Longer:

Continuing to work longer can also increase your Social Security benefits. Since your benefits are calculated based on your 35 highest-earning years, additional years of higher earnings can replace lower-earning years in the calculation, thereby increasing your average monthly earnings. This strategy is especially beneficial if you had periods of low or no earnings in your work history.

Coordinate with Your Spouse:

If you are married, coordinating your Social Security benefits with your spouse can also help maximize your combined benefits. Options such as 'file and suspend,' where one spouse files for benefits but suspends receiving them to enable the other spouse to claim spousal benefits, can optimize the total payout. Additionally, understanding and utilizing survivor benefits and spousal benefits can ensure that both partners receive the maximum possible amount.

Consider Working While Receiving Benefits:

If you decide to work while receiving Social Security benefits, be mindful of the earnings limits if you are under your FRA. Exceeding these limits can result in a temporary reduction of your benefits. However, once you reach your FRA, your benefits will be recalculated to give you credit for the months your benefits were reduced. This can increase your future monthly payments.

Monitor Your Earnings Record:

Regularly reviewing your Social Security earnings record can help ensure its accuracy, which directly impacts your future benefits. Mistakes can occur, and if your earnings are underreported or omitted, it can lower your benefit amount. Correcting these errors promptly can ensure that you receive the full benefits you are entitled to.

Conclusion:

Although Social Security benefits are often a significant source of retirement income, they should not be relied upon as the sole means of financial support during your golden years. It's essential to have a comprehensive retirement plan in place that takes into account other sources of income and factors such as inflation, healthcare costs, and long-term care needs. By understanding how Social Security benefits work and implementing strategies to maximize your benefits, you can help secure a more comfortable and financially stable retirement.

On this page

What are Social Security Benefits? Importance of Maximizing Your Benefits: Other factors that can affect your Social Security benefits: How to Apply for Social Security Benefits? Strategies to Boost Your Social Security Benefits: Delay Claiming Benefits: Work Longer: Coordinate with Your Spouse: Consider Working While Receiving Benefits: Monitor Your Earnings Record: Conclusion:

Learning the Art of Showing Your House to Buyers

Understanding the Solutions Unbanked Population Worldwide

Should You Cash in Your Pension? 5 Important Things to Consider

How to Deduct Stock Losses From Your Tax Bill

Navigating Early-Withdrawal Penalties - A Comprehensive Guide

Teen Tax Essentials: Empowering Financial Literacy

At What Age Does Car Insurance Go Down? Types of Coverage

An Essential Guide to the Federal Sales Tax Deduction

How to Get Your Overdraft Fees Refunded

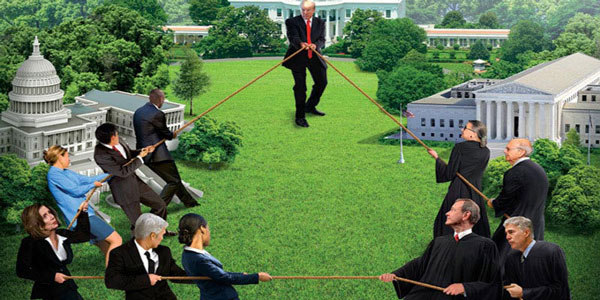

What Do You Need To Know About Checks And Balances?

Making Additional Payments on Your Loan Explained