Should You Cash in Your Pension? 5 Important Things to Consider

Sep 26, 2024 By Kelly Walker

People are always in a hurry to withdraw their tax free cash in pension as soon as its available. However, the limit age of a person for pension is 55 years but it is important to understand the implications of this decision. Moreover, the money remaining inside the pension gives you multiple advantages from taxes. This is why, whenever you decide to take out your tax-free cash from your pension, you should have a solid reason. To help you decide if you should cash in your pension funds, we have written this detailed article that explains the outcomes and reasons for cashing in your pension funds.

How can it Impact your Future?

The prime purpose of pension money is to support you after your retirement. You can use this money in the future when you will not be able to work. By taking the 25% tax-free cash from your pension you will be reducing the availability of your pot to make maximum income.

Furthermore, when you take out this money, you potentially reduce the chances of this money to grow. Withdrawing cash from your pension before your retirement will reduce growth in value via investment returns. If this this money remains invested, then there is are chance for it to grow.

For Example

For instance, if you withdraw 25% of 80,000 to a tax-free lump sum of 20,000. On the other hand, if that money remained invested in your pension, then your savings might have grown to 100,000. It would provide a tax-free lump sum of 25,000 with 5,000 more of your pension savings.

Take Help from Online Calculators

If you are considering withdrawing your cash from your pension but you are not sure. There are online calculators you can use to add your pot amount and the date you are planning to withdraw it. It will tell you the impact of your withdrawal on your future income.

Take Professionals Help

Managing finances and planning wisely is not a very simple task to do. Most people require professional assistance to manage and plan their finances and future incomes. This is why you should not hesitate to hire a professional finance advisor for your better future plans.

If you cannot afford professional help then the government also provides you free guide service help that is Pension wise. This guiding service provides you with help with your pension, future income, and the implications of withdrawing your pension.

Taxation Constraints on Pensions

While you cash in your pension, remember that all the taxes are based on individual circumstances. Tax rules may change later. Furthermore, the bank deposit will be shown as your estate inheritance for tax purposes. When you are exempt from this inheritance tax as it is still in pension and further assets in the bank, then it can create an issue in claiming state benefits.

If you do not withdraw your money, then it will grow. But, if you withdraw the tax-free pension and invest it somewhere else, then it can be a good initiative. You can rehome your cash in ISA without taxes, but you can pay a limited amount of money per year, which is 20,000.

When you feel confused about your future investments, you should go for professional paid-for advice. They will provide you with a tailored investment plan according to your pension. This is how you will get personal, professional financial advice.

Five Things to Consider Before Withdrawal of Your Pension

How much tax you will pay?

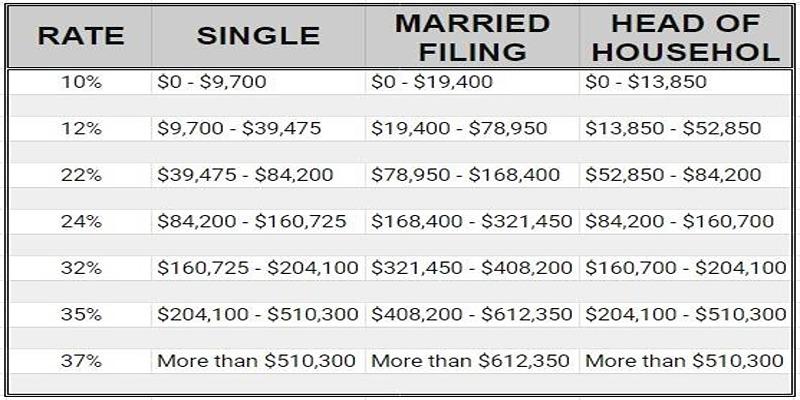

You should be aware of the tax implications after you withdraw 25% cash from your pension. However, if you ever withdraw more money, you will pay tax at your marginal rate. If you take multiple sums from your pension over a small span of time, you will risk yourself into a higher rate tax bracket for that tax year.

Pension Contributions

You could initiate the Money purchase annual allowance (MPAA) by start taking out income. This will happen if you move your pension savings money into a flexible access drawdown. You can still save some money, but the amount will be reduced. However, you can always take a professionals help in this matter.

Good Time to Make a Withdrawal

It is very important to think carefully when you are planning to access your pension. It depends upon when and where you are withdrawing your money. Furthermore, if you withdraw cash from investments that have fallen in value, you could exhaust your pot much quicker than it grows.

Later Life Planning

After retirement, everyone requires a life free of tension and stress. To prosper in that life, you should plan your present accordingly. Be aware of the fact that you will need that money in your future, you are withdrawing now.

Can you afford to Withdraw Money?

You might think that you can afford to withdraw your pension, but nobody knows what lies in the future. This is why you should always be very cautious about your future because you might need this money in the last decades of your life.

Conclusion

The limit age of a person for pension is 55 years but it is important to understand the implications of this decision. Be aware of the fact that you will need that money in the future, so you should plan your present accordingly. Withdrawing cash from your pension before your retirement will reduce growth in value via investment returns. We hope the above information was helpful to you.

On this page

How can it Impact your Future? For Example Take Help from Online Calculators Take Professionals Help Taxation Constraints on Pensions Five Things to Consider Before Withdrawal of Your Pension How much tax you will pay? Pension Contributions Good Time to Make a Withdrawal Later Life Planning Can you afford to Withdraw Money? Conclusion

The Role of the US Dollar in Shaping Commodity Prices Across Markets

Ways to Predict Market Performance

Navigating Early-Withdrawal Penalties - A Comprehensive Guide

Making Additional Payments on Your Loan Explained

How to Get the Most of Your Social Security Benefits

What Is a Loss Carryback?

Understanding the Solutions Unbanked Population Worldwide

What Is a Tax Table?

How the Stock Market Stays Fair: An Overview of Regulations

How to Create a Cash Flow Projection for Your Business: A Step-by-Step Guide

How Much Money Can Day Traders Make?