Ways to Predict Market Performance

Jan 03, 2025 By Kelly Walker

With stock markets all over the world constantly fluctuating, investors must be vigilant and strategic in their decision-making to ensure they are making informed decisions about which investments represent the greatest potential for returns.

The ability to accurately predict future market performance can be the difference between maximizing returns or suffering significant losses.

In this blog post, we take a deep dive into ways you, as an investor, can best predict market performance and give yourself every advantage when it comes time to make your next investment move.

Learn The Basics Of Financial Analysis and Understand How To Read Financial Statements

Financial analysis is vital to understanding how the stock market functions and predicting future performance. By learning the basics of financial analysis and knowing how to read financial statements, investors can better assess a company's overall health and make decisions about potential investments.

Knowing what numbers to look for on balance sheets and income statements can help investors understand trends, identify red flags, and make educated decisions. The financial analysis also helps investors understand different economic policies impact on the markets and assess how those policies could influence their investments in the future.

By utilizing financial statements as part of an overall market analysis strategy, investors can better understand how to leverage their investments for maximum returns.

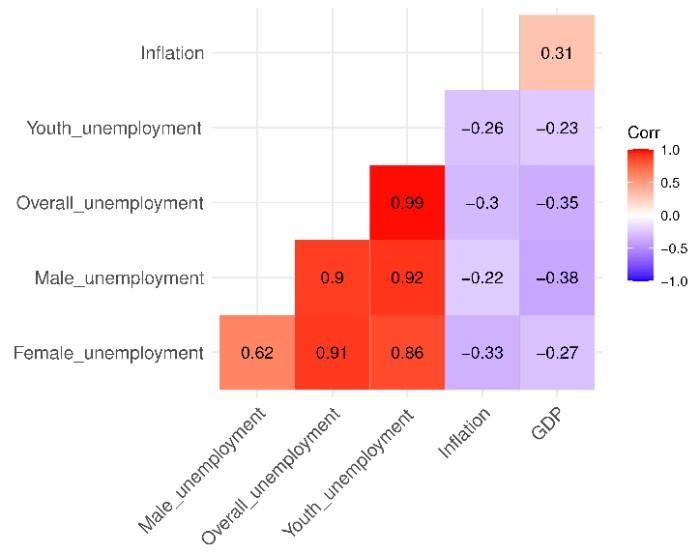

Analyze Macroeconomic Trends Such as GDP, Employment Figures, Inflation, and Interest Rates

Analyzing macroeconomic trends such as GDP, employment figures, inflation, and interest rates is key to predicting market performance. Gross domestic product (GDP) is an important indicator of a nation's economic health and can be used to identify potential growth or recession in the coming months.

Employment figures indicate how many workers are employed or unemployed and provide insight into the labor market's strength and consumer spending. Inflation measures how quickly prices rise or fall, indicating whether a nation's economy is in good health or headed for trouble.

Finally, interest rates reflect the loan worthiness of individuals and companies and the cost of borrowing money from banks, affecting investment decisions. By paying close attention to these macroeconomic data points, investors are in a better position to make informed decisions about potential investments.

Follow News About Global Events That Could Affect Market Performance

Investors need to stay informed about global events that could affect market performance. The news should be followed regularly, especially regarding economic and political conditions, as these can cause major fluctuations in stock markets worldwide.

It’s also important to pay attention to changes in commodity prices, interest rates, inflation rates, and currencies- all of which can directly impact stock market performance.

Following news related to the global economy, major companies, and industries will also aid in predicting markets and understanding potential risks and opportunities.

Additionally, paying attention to sentiment towards certain stocks or sectors can provide valuable information about how investors view possible investments.

By keeping up with the news and trends related to global events, investors can better understand how the markets may react and make more informed decisions about their investments.

Pay Attention To Stock Market Indexes such as the Dow Jones Industrial Average

When investing, it is important to pay close attention to stock market indexes such as the Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ. These indices provide a measure of the performance of large companies and can be used to gauge overall market sentiment.

By tracking these indexes, investors can stay up-to-date on the latest market developments and make informed investment decisions. The DJIA is a particularly important index, as it tracks 30 of the largest and most influential companies in the U.S.

It can be used to identify broad trends in the stock market that could impact individual stocks or sectors. Doing so will give you an edge over other investors when it comes time to make your next move.

Investigate Company Performance Through Researching Earnings Reports and News Releases

Investing in stocks can be daunting as there are many variables to consider before making an educated decision.

One of the most important ways to predict market performance is by researching company performance through earnings reports and news releases. These documents provide detailed information about a company's financials, such as its income, expenses, profits, losses, etc.

By understanding how the company has performed in the past and its prospects, investors can make informed decisions about whether or not that company is worth investing in.

Additionally, research into news releases allows investors to ascertain potential changes in the industry or with the company itself that may affect future stock prices. This type of research can be invaluable for predicting market performance and helping investors make wise investment choices.

By taking the time to review earnings reports and news releases, investors are ensuring they have a full understanding of the company's performance before making any investment decisions. This information can be invaluable for predicting market performance and is essential to successful investing.

Stay Informed About Changes In Laws and Regulations That Could Affect Markets

Keeping up with developments in stock market laws and regulations is essential for predicting market performance. Laws and regulations can significantly impact how external factors, such as changes in the global economy, influence markets.

Knowing which laws and regulations may be implemented or modified can help you anticipate where a particular market might go.

By staying informed about potential changes to laws and regulations that could affect markets, you’re giving yourself an advantage over competing investors who may not be aware of the same information.

Keep your ear to the ground – monitoring news sources, joining industry groups, and attending conferences – so that you don’t miss out on any important updates that could cause a shift in market trends.

Monitor Corporate Actions such as Mergers and Acquisitions To Get an Idea of Future Performance

Monitoring corporate actions can be a great way to gain insights into future market performance. Mergers and acquisitions, for example, often lead to increased stock prices as the company grows and expands its business.

Looking out for such news can help investors anticipate potential spikes or dips in the market, allowing them to make educated decisions about when buying or selling stocks is most beneficial.

Additionally, they can look at what types of companies are being acquired – which industries are being targeted? What companies are seeking to acquire others? Such analysis can reveal valuable information about where the market may be headed.

By keeping an eye on these developments, investors can prepare themselves for potential opportunities or risks that could arise in the future. This proactive approach helps ensure investors make informed decisions about their investments.

FAQs

What is the best way to predict the market?

The best way to predict the market is to use various methods, including technical analysis, fundamental analysis, and macroeconomic indicators. Technical analysis involves analyzing stock charts and past price movements to identify trends that may indicate future performance.

What is the best prediction indicator?

The best prediction indicator depends on the investor's goals and risk tolerance. For example, technical analysis is often used by day traders looking for short-term gains, while fundamental analysis is more useful for longer-term investors looking to identify companies that will provide sustained returns over a longer period.

What other factors should investors consider when predicting market performance?

Investors should also consider macroeconomic indicators such as economic growth, interest rates, inflation, and political events. They should also be aware of news and events that could affect the stock market, such as corporate earnings announcements and mergers and acquisitions.

Conclusion

Predicting market performance requires a knowledgeable approach. Learning basic financial analysis and understanding how to read financial statements can provide insights essential to gauge market performance. Moreover, macroeconomic trends should be remembered.

Global events impacting market performance should also be considered to get a clear picture. Furthermore, understanding stock indexes, following company-specific news releases, and earning reports can further help understand the markets. Lastly, constantly monitoring changes in laws and regulations will bring investors one step closer to figuring out global market trends.

On this page

Learn The Basics Of Financial Analysis and Understand How To Read Financial Statements Follow News About Global Events That Could Affect Market Performance Pay Attention To Stock Market Indexes such as the Dow Jones Industrial Average Investigate Company Performance Through Researching Earnings Reports and News Releases Stay Informed About Changes In Laws and Regulations That Could Affect Markets Monitor Corporate Actions such as Mergers and Acquisitions To Get an Idea of Future Performance FAQs What is the best way to predict the market? What is the best prediction indicator? What other factors should investors consider when predicting market performance? Conclusion

Understanding the Average Cost of Adoption in the United States

At What Age Does Car Insurance Go Down? Types of Coverage

How Much Time Is Required to Establish Good Credit From Beginning?

Ways to Predict Market Performance

What Is a Solvency Capital Requirement (SCR)?

How to Create a Cash Flow Projection for Your Business: A Step-by-Step Guide

The Role of the US Dollar in Shaping Commodity Prices Across Markets

What Is a Loss Carryback?

How Much Money Can Day Traders Make?

Making Additional Payments on Your Loan Explained

How to Use Venmo and How It Compares to Competitors: Everything You Need to Know